A typical subscription line credit facility (a “Facility”) has an initial tenor of 1-3 years. Closed-end fund borrowers often have investment periods that range from 4-10 years during which time the funds typically desire continued access to the line of credit to facilitate the making of investments. To accommodate these different time frames, many Facilities offer borrowers maturity date extension options, which can be in two forms:

- A committed extension option requires certain specified conditions to be met (e.g., no defaults, representations and warranties remaining true and correct, and payment of fees), but allows the borrower to request and receive an extension of the Facility maturity date (typically up to a year) without the consent of the lenders.

- An uncommitted extension option pre-wires mechanics to extend the maturity date into the loan documents but may be subject to further agreement among the parties as to terms of the extension and ultimately leaves the decision to accept the borrower’s request for an extension to each lender, in its sole discretion.

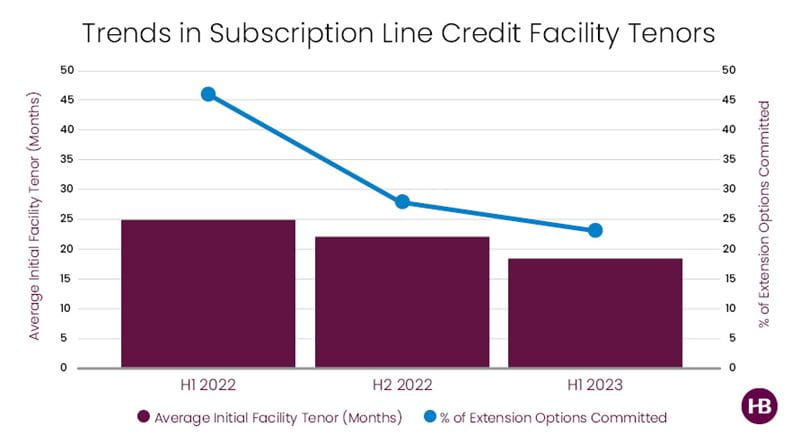

As the graph above indicates, there was a clear downward trend in the length of initial Facility tenors during the past 18 months, with average tenors decreasing from over 24 months in the first half of 2022 down to 18 months as of the latest data from the first six months of 2023.

While there was no material change in the percentage of Facilities including an extension option of some kind (about 75% of Facilities), the percentage of these extension options that were committed decreased drastically over this same period, from 46% down to 23%.

Facility tenor decreases, and corresponding decreases in committed extension options, have been driven by:

- heightened bank capital reserve requirements and the favorable treatment of shorter 364-day facilities;

- fundraising slowdowns that have cautioned lenders to re-evaluate fund borrowers at completion of their targeted fundraising;

- rising and volatile interest rates, making parties cautious to lock in rates for a prolonged period of time without the ability to re-negotiate in the near term;

- the abrupt exit of a few historically active lenders in the subscription line space that has caused remaining lenders to prefer shorter tenors as the uncertain market settles; and

- new lenders entering the market, seeking shorter tenors as they gain familiarity and comfort in the subscription line space.

Even when extension options are uncommitted, lenders often agree to extend the term of the Facility. However, an uncommitted extension option allows flexibility for the lenders to reanalyze the current structure and environment and renegotiate pricing, borrowing bases, and other key provisions in the shorter term.

These insights are based on data from hundreds of Facilities Haynes Boone worked on during this period for tier-one U.S. and international lenders, super-regional and regional lenders and newer entrants.

For more information on Fund Finance market trends, please reach out to any member of the Haynes Boone Fund Finance Practice Group.

For additional News and Insights, please subscribe to our email list.