Under a typical subscription line credit facility, lenders commit to lend an agreed maximum amount to the borrowers so long as the borrowers satisfy certain criteria outlined in the loan documentation (a “Committed Facility”)1 – that is, the lenders do not have discretion to decide whether or not they will honor a draw request if the borrowers satisfy such conditions. However, and unsurprisingly given current market conditions, in the past year we have seen a marked increase in the number of uncommitted subscription line credit facilities in the market (each, an “Uncommitted Facility”). In Uncommitted Facilities, lenders are not contractually obligated to make loans to the borrowers and may decline to fund any requested loan in their sole discretion.

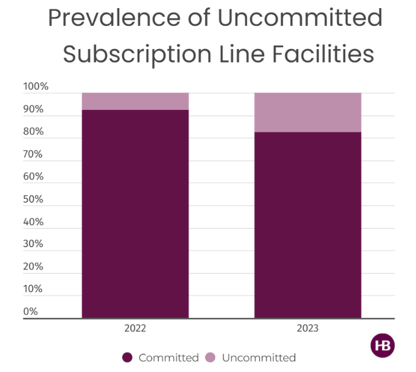

Uncommitted Facilities have not historically been prevalent in the subscription line space, but as the accompanying graph shows, we have seen an approximate 130% increase in new Uncommitted Facilities from 2022 to 2023, increasing from just 7.5% of the subscription credit facilities our team documented in 2022 to 17.5% in 2023 YTD.

Uncommitted Facilities offer several benefits to both sponsors and lending institutions, including:

- Uncommitted Facilities often come with more favorable pricing for the borrowers because the banks don’t have to set as much capital aside for liquidity requirements as they would for a Committed Facility.

- Uncommitted Facilities typically do not require the borrowers to pay an unused fee on undrawn amounts, a standard feature in Committed Facilities, because lenders do not have to reserve undrawn capital. In some instances, the lenders may also forego receiving an upfront fee; however, often there will be an additional “draw fee” in connection with any approved request for borrowing.

- Lenders in Uncommitted Facilities have more control over the effective tenor of a facility, as they can effectively terminate a facility by rejecting requests to draw on the line and are under no obligation to continue lending under the facility. Some Uncommitted Facilities also include a demand feature that allow the lenders to demand repayment of the full outstanding amount at any time. These features often, and understandably, give borrowers pause about entering into Uncommitted Facilities, as discussed below.

- Lenders entering into Uncommitted Facilities are also able to mitigate structural risks that may otherwise prevent them from agreeing to a Committed Facility. Particularly for funds early in their lifecycle with concentrated or small investor pools, or at the end stages of their lifecycle with only a few investments and a smaller uncalled commitment pool, the ability of the lenders to monitor and reassess the relationship at the time of each draw request provides them with the protection they need to enter into the facility.

The obvious downside of an Uncommitted Facility from a sponsor perspective is that there is no guaranteed access to the credit facility at any given time. Many lenders, despite the uncommitted nature of the facility, reassure the borrowers of their intention to fund requested loans and have a compelling history of approving funding requests in Uncommitted Facilities. Declining to fund a loan can damage a long-term lending relationship and can come with significant reputational risk in the market, and these factors do serve as comfort to borrowers. Another sponsor downside is that Uncommitted Facilities are logistically and operationally difficult to syndicate, as each lender has the discretion to approve or reject each borrowing request. This can get particularly challenging when you have certain lenders opting into letter of credit requests and others not. Because of this complexity, we often see Uncommitted Facilities as single-bank transactions, which naturally may limit a sponsor’s access to larger capital amounts.

Despite these considerations, in the right circumstances, Uncommitted Facilities can work for both parties. Uncommitted Facilities provide access to funds (sometimes otherwise unavailable via a Committed Facility) and reduce costs for the borrowers, all in the context of more flexibility and deployable capital for the lenders. We intend to monitor the increase in use of such structures in light of recent bank failures, the higher interest rate environment, investors’ laser focus on partnership expenses, and new proposed banking capital regulations. While still not anywhere close to a majority of the subscription line credit market, Uncommitted Facilities remain a viable financing solution for certain parties, and we expect their prevalence to increase through 2024 and perhaps beyond.

These insights are based on data from hundreds of subscription credit facilities that Haynes Boone documented during this period for the largest domestic and international lenders, as well as for regional banks and super regionals.

For more information on Fund Finance market trends, please reach out to any member of the Haynes Boone Fund Finance Practice Group.

For additional News and Insights, please subscribe to our email list.

1 The conditions to each borrowing after the initial draw often include re-making all representations and warranties in the loan documents as of the date of the loan request and certifying that no event of default or potential default exists at the time of the request or would result from the proposed borrowing.