When a subscription line credit facility (“Subscription Facility”) involves cross-border elements, there may be nuanced local law requirements to consider depending on the jurisdiction in which a fund is established, including requirements for the creation and perfection of security interests.

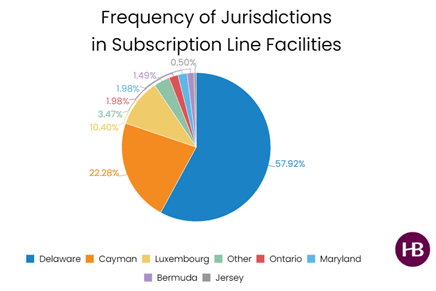

Over the last 12 months, we have documented Subscription Facilities with investment funds established in a wide variety of jurisdictions (and often multiple jurisdictions are present in a single facility). The chart below sets forth the frequency of jurisdictions included in Subscription Facility transactions from the prior year as a percentage of the total number of transactions analysed.

*Some of the more common jurisdictions in the ‘Other’ section include Japan, Australia, Scotland, and various US states and Canadian provinces.

Below we have provided a high-level summary of a few key local nuances in the more common fund jurisdictions we have seen over the past year.1 Although the below presents important considerations, it is imperative to engage local counsel early in a transaction involving foreign funds, so as to ensure the loan documents and collateral structuring comply with jurisdictional specific requirements.2

- Delaware: Delaware is by far the most common fund jurisdiction seen in US structured fund finance transactions. There is established case law3 and lender-friendly statutes that provide comfort to lenders advancing funds secured by the capital commitments of fund investors. One such statute is Section 17-502(b)(1) of the Delaware Revised Uniform Limited Partnership Act, which states that a creditor may ‘rely’ on the original obligations of the limited partners to the fund and enforce such obligation “to the extent that, when extending credit, the creditor reasonably relied on the obligation of a partner to make a contribution or return”.

- Cayman Islands: Cayman Islands law does not require that security over Cayman Islands assets be taken under local law. It is therefore common for New York law-governed facilities to solely have New York law-governed security documents covering capital commitments to Cayman Islands established funds, while European deals usually rely on Cayman Islands governed security documents. Priority rights over the capital call security is created by delivering notice of the security to the investors. It is also worth noting that private funds in the Cayman Islands are required to register with the Cayman Islands Monetary Authority within 21 days from accepting capital commitments under the Caymans Islands Private Funds Act (Revised) (the “PF Act”). No such fund can accept capital contributions from investors until it is duly registered. Where an obligor in a financing is a Cayman Islands fund, a specific representation that the applicable obligor is in compliance with the PF Act should be included. A corresponding covenant will also require the applicable obligors to maintain such registration and provide satisfactory evidence of such registration to the Administrative Agent.

- Luxembourg: Security in Luxembourg for Subscription Facilities is perfected via a Luxembourg-law governed pledge agreement accurately listing the investor capital commitments subject to the security. Although investor notices are not required for perfection, they are standard as they create priority. Notification of account security governed by the laws of the Grand Duchy of Luxembourg is perfected by notifying the account bank of the pledge (with receipt acknowledged). The concept of lex situs applies in Luxembourg, meaning that when determining the creation, perfection and enforcement of security, Luxembourg courts will take into consideration the law of the place where the asset subject to the security is situated. For this reason, where security is taken over the same Luxembourg assets in more than one jurisdiction, the security that is governed by the laws of Luxembourg should be first ranking.

- Canada: Investor notices are not required for perfection of capital call security, and PPSA statements (which are similar to UCC statements) are used to perfect the typical subscription line collateral. Control agreements are also not required for security granted over bank accounts. Rather, security over bank accounts is perfected by way of registration. It’s also worth noting that the Criminal Code of Canada makes it an offense to enter into an agreement to assess certain excessive interest rates. Canadian counsel will help craft protective language to avoid any usury concerns. We would note finally that the laws of the Province of Quebec differ from other provinces and may have separate requirements that should be discussed with Quebec counsel.

- Maryland: The prevalence of Maryland in Subscription Facilities is largely driven by its desirability when forming Real Estate Investment Trusts (REITs) and Business Development Corporations (BDCs). While the creation and perfection of security interests for Maryland funds is largely the same as in Delaware or other US states, it is worth noting that REITs and BDCs are often structured as corporations or limited liability companies, as opposed to limited partnerships. Counsel needs to holistically review the underlying governing documents to ensure the same bankable provisions that are standard in limited partnership agreements are found in these documents.

- Bermuda: As with Cayman Islands law, it is not necessary to have local law security granted over a Bermuda fund’s right to make capital calls. The governing law of security over the assets of a Bermuda fund is usually governed by the same law governing the credit agreement. The Bermuda fund will be required to deliver investor notices. Charges granted by corporations in Bermuda (or limited partnerships with separate legal personality) to non-Bermuda secured parties can be registered in Bermuda with the Registrar of Companies to secure priority of such charge. For limited partnerships not having separate legal personality, charges over property situated in Bermuda can be registered with the Registry General to secure priority.

- Jersey: Jersey law governed capital call security is perfected by registering a financing statement on the Jersey Security Interests Register maintained by the Jersey Financial Services Commission (the “JFSC”). It’s not necessary to deliver investor notices in order to perfect security, but it is market standard. Security over bank accounts can be perfected by either (i) control (this is achieved by sending notice to the third party account bank or the first party account bank being party to the security), or (ii) the registration of a financing statement on the Jersey Security Interest Register maintained by the JFSC. Security over accounts which is perfected by control will have priority over security perfected by registration, so in practice both methods of perfection are often used.

These insights are based on data from hundreds of Subscription Facilities documented by Haynes Boone during this period for the largest domestic and international lenders, as well as for regional banks and super regionals.

For more information on Fund Finance market trends, please reach out to any member of the Haynes Boone Fund Finance Practice Group.

For additional News and Insights, please subscribe to our email list.

1 We would also call your attention to the Global Legal Insights: Fund Finance yearly publication, which has a more in-depth analysis of jurisdictional specific nuances.

2 Haynes Boone has relationships with law firms all around the globe. Should you encounter any novel jurisdictional considerations, we would be happy to leverage our existing relationships to make an introduction to attorneys practicing in the applicable jurisdiction.

3 See In re LJM2 Co-Investment, L.P. Ltd. Partners Litig., 866 A.2d 762 (Del. Ch. 2004) (confirming that creditors can enforce their rights against limited partners notwithstanding attempts by such partnership or its limited partners to limit or excuse the limited partners’ obligation to make capital contributions).