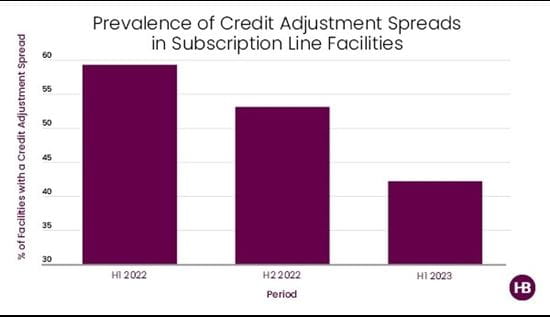

The prevalence of Credit Adjustment Spreads (or “Spread Adjustments”) in subscription line credit facilities (“Facilities”) is decreasing. In recent years, the Spread Adjustments have been incorporated to adjust (increase) a SOFR rate interest option to compensate lenders for the economic difference between how LIBOR (and its risk based credit premium) and SOFR (a risk free rate) are calculated. In the first 6 months of 2022, almost 60% of new Facilities contained a Spread Adjustment. As of the first 6 months of 2023, this figure was down to just over 42%.

A Spread Adjustment was often used when converting a Facility from LIBOR to SOFR, or if lenders and borrowers were comparing the pricing of a new Facility to a prior Facility that was based on LIBOR. But, after December 31, 2021 (the date regulatory agencies stated that entering into new LIBOR contracts would create safety and soundness risks) and leading up to the LIBOR cessation date (June 30, 2023), term sheets and pricing discussions occurred in an environment where SOFR was a primary reference rate used for US dollar credit facilities, and Spread Adjustments became less prevalent.1

For those Facilities continuing to incorporate a Spread Adjustment, the spread amount is becoming more negotiated and bespoke. Of those Facilities that include a Spread Adjustment, the percentage incorporating the Alternative Reference Rates Committee (“ARRC”) recommended historic Spread Adjustment levels decreased from 50% in H1 2022 to 22% in H1 2023. Many Facilities are incorporating a flat 10 bps Spread Adjustment for Daily SOFR and SOFR with a 1-month duration, which is lower than the ARRC recommendations.2

However, while a LIBOR-to-SOFR Spread Adjustment may not have continued relevance in the coming years, the concept will undoubtedly remain. There are several other reference rates ceasing or under investigation (e.g., Singapore SIBOR, Canadian CDOR), and the use of a Spread Adjustment may be recommended when converting Facilities based primarily on these currencies to the new recommended reference rates. In addition, the possibility of a Spread Adjustment will remain a concept included in most generic benchmark replacement provisions.

These insights are based on data from hundreds of Facilities Haynes Boone worked on during this period for tier-one U.S. and international lenders, super-regional and regional lenders and newer entrants.

For more information on Fund Finance market trends, please reach out to any member of the Haynes Boone Fund Finance Practice Group.

For additional News and Insights, please subscribe to our email list.

1 This Insight focuses on the use of a separate pricing adjustment being added to the SOFR rate, not the process of factoring in the Spread Adjustment into the underlying pricing of the deal. For example, if Facility A was LIBOR + 230bps, a comparable Facility B with a Spread Adjustment may be SOFR + 230bps + a Spread Adjustment of 10bps. However, Facility B without using a Spread Adjustment could be priced at SOFR + 240bps).

2 ARRC recommended the five-year historical median difference between LIBOR and SOFR, set on March 5, 2021, which set the Spread Adjustment for various tenors as follows: 1 month = 11.448 basis points; 3 months = 26.161 basis points; and 6 months = 42.826 basis points.