Several years ago, it was fairly uncommon to see sponsors refinance an existing credit facility with another lender. Refinancings did occur, but the pool of lenders in the market was smaller (giving the sponsors fewer options) and the interest rates and pricing were lower (resulting in less of a need to refinance). However, market conditions have resulted in a sharp uptick in refinancings in 2023.

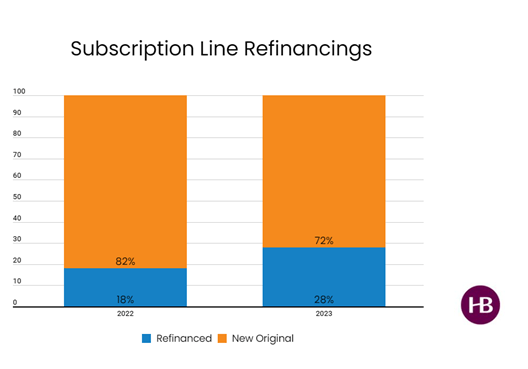

Across the hundreds of subscription line credit facilities (“Subscription Facilities”) our team documented in 2022, 18% of them were refinancings; in 2023 YTD that number increased by more than 50%, with the overall volume of refinancings at 28%.

While the prevalence of refinancings year over year is noteworthy, when looking more closely at the data, other trends and explanations emerge:

- Earlier this year the Fund Finance market experienced its own version of “March Madness” after the collapse of several prominent banks in the industry. Several of these banks were acquired, and the remaining fund finance loan portfolios of the collapsed banks were subsequently auctioned off. Additionally, in response to ongoing concern surrounding deposits and loan exposure, several other banks commenced sell-offs or exits of all or a portion of their fund finance loan portfolio. This market turmoil caused many borrowers to reanalyze their current lending relationships (or in the case of loans that were acquired from failed banks, new lending arrangements) and seek refinancings with other banks and accounts for a substantial share of the refinancings seen in 2023. This is particularly true with respect to loans that were scheduled to be sold by the FDIC (via auction or acquisition of a failed bank) as sponsors sought to maintain control over their lending relationships and prevent the spread of confidential information.

- The data shows the facilities being refinanced are smaller, often bilateral. While they account for 28% of the number of facilities refinanced in 2023, they only account for 15% of the volume when looking at the maximum facility sizes. This anecdotally supports the trend we have seen where some funds have refinanced smaller facilities originally held with regional or failed banks with lenders viewed as more financially stable.

- In July 2023, the US federal banking regulators issued proposals that, if finalized, would significantly impact bank regulatory capital requirements, a material factor in determining the attractiveness and feasibility of various fund finance facilities. Some of the major lenders in the space have since been more selective in which fund sponsors they support, given internal capital restraints, declining to renew some facilities and causing some sponsors to refinance with other lenders.

- One contributing factor to the number of refinancings includes the shortening of facility tenors, as borrowers may look elsewhere when it comes time to renew these facilities.

- With higher interest rates, and a slower and more challenging fundraising market, fund sponsors are being judicious on how much financing they really need during the course of determining their refinancing options.

A surge in refinancings this past year is not surprising given the March Madness disruption and the other factors we have described. While overall “deal flow” in the fund finance markets appears to remain constant, notwithstanding the global headwinds of 2023, the amount of new financing actually available to fund sponsors has been negatively impacted by the percentage of deal activity driven by refinancings, the March Madness disruption and by the overall decrease in initial facility sizes.

These insights are based on data from hundreds of Subscription Facilities documented by Haynes Boone during the referenced period for the largest domestic and international lenders, as well as for regional and super-regional banks.

For more information on Fund Finance market trends, please reach out to any member of the Haynes Boone Fund Finance Practice Group.

For additional News and Insights, please subscribe to our email list.