Haynes Boone Partner Kraig Grahmann authored an article for World Oil on the findings of the Fall 2023 Borrowing Base Redeterminations Survey, including an increased interest in financing new development oil and gas wells but a tight reserve-based lending (RBL) market.

Read an excerpt below:

In October, Haynes Boone released its fall 2023 Borrowing Base Redeterminations Survey, which showed an increased interest in financing new development oil and gas wells but a tight reserve-based lending (RBL) market. Respondents also don’t expect meaningful borrowing base increases this determination season, despite favorable oil and natural gas prices.

An RBL financing is structured as a revolving loan with credit availability, based on the value of an upstream producer’s oil and gas reserves.

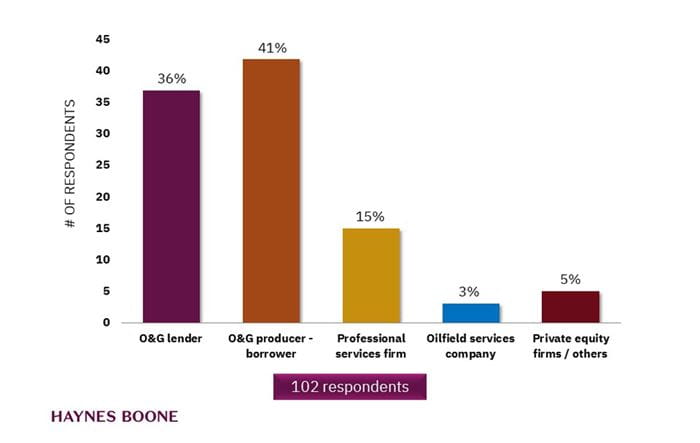

Haynes Boone conducted the survey following a third-quarter run-up in commodity prices driven by strong global demand for oil and natural gas, as well as conflict in the Middle East. This is the firm’s 18th semi-annual borrowing base redeterminations survey since 2015 and includes input from more than 100 executives at oil and gas producers, financial institutions, private equity firms and professional services, Fig. 1.

To read the full article in World Oil, click here.