Haynes Boone Partner Aleks Kopec and Counsel Maria Parker authored an article for LexisNexis Practical Guidance discussing financial covenants in subscription line facilities.

Read an excerpt below.

At a basic level, financial covenants require the borrower to maintain a certain level of financial strength and stability. Generally, subscription line facilities are ‘’covenant-lite’’ in comparison to net asset value facilities and traditional leveraged and investment grade loans because subscription line facilities rely on the uncalled capital commitments of a fund’s investors for repayment rather than the financial performance of the fund itself (or its assets). However, financial covenants are sometimes utilized by lenders in subscription line facilities to set minimum net worth tests or other measures focused on the fund itself. Breach of a financial covenant may trigger review or action, including, potentially, an event of default, and the existence of the covenant may improve the underwriting parameters a lender considers when evaluating the risk profile of a borrower in entering into a credit facility. In certain circumstances, financial covenants can be a useful tool to prompt early warning signs of potential distress and minimize the risk of payment default.

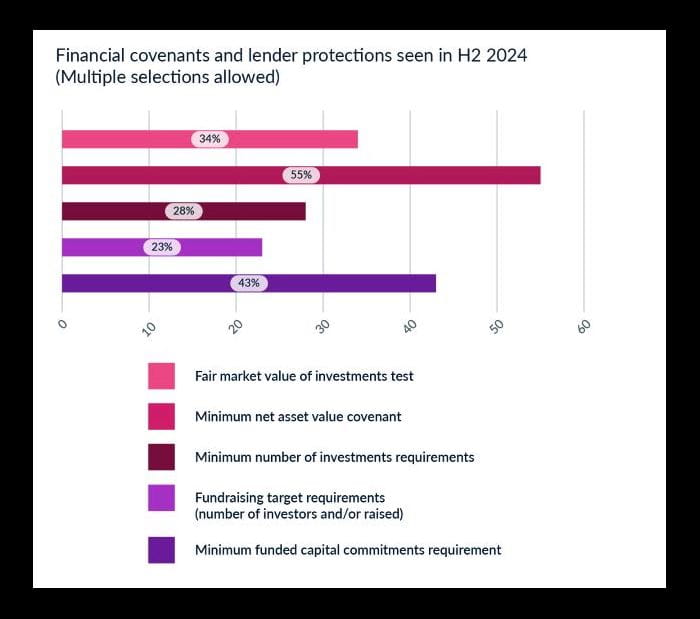

Lenders may require financial covenants for newer sponsors, smaller funds, or when a significant investor is a ‘’hurdle’’ investor, so that in addition to a delay in including the commitment of such investor in the borrowing base, the fund is required to maintain a minimum net worth as a second ‘’hurdle’’. Financial covenants can be applied at different times during the term of a credit facility and at various stages of a fund’s lifecycle. The most common financial covenants used in subscription line facilities are listed below. This data is from the Haynes Boone Annual Report and is based on responses from over 100 different institutions in the fund finance industry.

- Fair Market Value Test: The fund is required to maintain a minimum fair market value of portfolio assets, representing the current price of the fund’s portfolio assets in the market, in excess of some set percentage of the cost of such asset. For example: ‘’The aggregate fair market value of all unrealized Investments of the Borrower, as of the last day of each calendar quarter, shall not be less than an amount equal to 65% of the cost of such Investments, as of the date of such measurement’’. This test ensures the assets of the fund, which serve as a secondary source of repayment for lenders (after the capital commitments of the investors), are not deteriorating to dangerous levels.

- Net Asset Value Test: The fund is required to maintain a minimum net asset value of portfolio assets. The net asset value is calculated by taking the current fair market value of all or certain portfolio assets and subtracting any liabilities. This covenant can be tested on a quarterly or yearly basis and across a select group of investments or the fund’s entire portfolio investment. Variations of this test may include: (i) a stepdown (once the net asset value is below a certain level, the facility size and advance rate automatically decrease), or (ii) a ‘’covenant holiday’’ (during a specified period of time the requirement is either suspended or starts at a lower level thereby giving the fund more flexibility during this period). For example: ‘’(a) from the Closing Date through December 31, 2025, the Net Asset Value divided by the sum of all Principal Obligations shall equal at least 1:1 and (b) from January 1, 2026 through the Maturity Date, the Net Aset Value divided by the sum of all Principal Obligations shall equal at least 2:1’’. The net asset value test can be a key safeguard in credit facilities since it protects lenders from the potential loss of a secondary source of repayment and gives lenders comfort that the value of the fund’s portfolio assets remains sufficient to cover any outstanding obligations.

- Asset Coverage Ratio: This financial covenant measures the fund’s capacity to repay its debts by requiring the fund to maintain a minimum asset coverage ratio (typically calculated as the ratio of (a) total assets minus total liabilities to (b) total amount of consolidated debt of the loan parties). This test can be a key financial metric to measure the fund’s financial solvency and overall risk profile and can be utilized to assess the fund’s ability to meet its future debt obligations.

To read the full article in Practical Guidance, click here.