With rising interest rates, recent articles1 have emphasized the prevalence, and dangers, of borrowers “deferring interest” via capitalization (aka a payment-in-kind provision, or “PIK provision”). A PIK provision essentially allows a borrower to add interest payments when due to the outstanding loan principal, instead of paying in cash when due, thereby increasing the unpaid balance of the loan and the lenders’ exposure to the borrower.

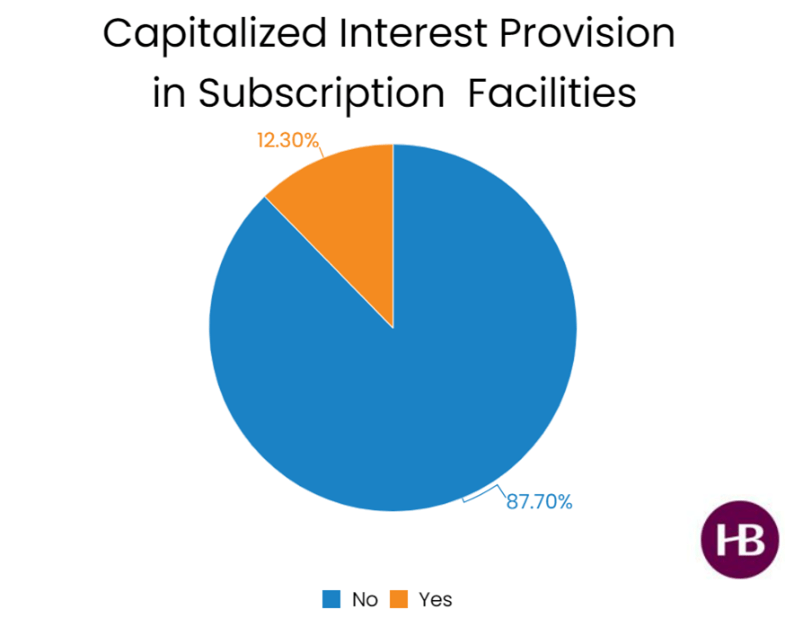

In the subscription line credit facilities (“Subscription Facilities”) our team documented in 2022, only 10% had a PIK provision; in 2023 YTD that number increased by almost 25%, but the percentage of overall deals with a PIK provision still remains low, at 12.3%.

While recent articles have highlighted PIK provisions as a tool for struggling borrowers across finance products, in Subscription Facilities another primary motivation for borrowers is convenience. Paying in kind helps funds manage cash flow and allows them to avoid having to call capital from investors for interest payments on a monthly or quarterly basis. In turn, since these are not distressed or unsecured loans, lenders in Subscription Facilities sometimes consider incorporating a PIK provision based on the strength of the underlying fund and the amount of overcollateralization available vis-à-vis advance rates, concentration limits and investor designations.

In addition to an economic analysis of the overall financial strength of the borrower, parties negotiating PIK provisions in Subscription Facilities should consider the following drafting issues:

- How does the borrower elect to capitalize the interest? In some instances, the default mechanic may be that all interest is capitalized unless notice is provided or conditions are not met (see below). In others, the default mechanic may be that interest will be paid in cash unless sufficient notice is provided to capitalize the interest. Parties could, instead, agree that the borrower will elect, at the time of each borrowing request, whether the interest for such borrowing will be capitalized.

- Under what conditions may interest be capitalized? Subscription Facilities, like other finance products, include a list of conditions precedent to each borrowing. Lenders must decide which of these conditions must also be satisfied to enable the borrower to capitalize interest. The conditions to capitalizing interest can range from solely no borrowing base deficiency to more robust conditions such as no events of default or potential defaults, a bring down of all representations and warranties, and providing confirmation of no borrowing base deficiency (after giving effect to the requested capitalization of interest) by delivering an updated borrowing base certificate.

- Do borrowers also capitalize any fees? Borrowers requesting a PIK provision may also ask for the ability to capitalize certain fees, in particular unused commitment fees. When capitalizing the interest applicable to a particular loan, the parties often agree to simply increase the principal amount of the underlying loan for the interest amount due, thereby keeping the same type of loan, including interest and tenor elections. If lenders agree to capitalize fees, the parties must decide which type of loan will be advanced to cover such fees as they become due.

- Are there any other drafting considerations? If a Subscription Facility has minimum/multiple amounts required for loans, a maximum number of loan tranches outstanding, or alternative currency or other sublimits, the parties need to consider how each of these limits will apply to a loan resulting from a PIK provision.

While PIK provisions remain a somewhat uncommon feature in Subscription Facilities, parties who wish to include them should discuss the considerations noted above. Agents in syndicated facilities should also note that, given its relatively low prevalence in the market, certain lenders may not be familiar or comfortable with PIK provisions (or may even have internal policies prohibiting their use), which could impair future syndication of a Subscription Facility with PIK provisions.

These insights are based on data from hundreds of Subscription Facilities documented by Haynes Boone during the referenced period for the largest domestic and international lenders, as well as for regional and super-regional banks.

For more information on Fund Finance market trends, please reach out to any member of the Haynes Boone Fund Finance Practice Group.

For additional News and Insights, please subscribe to our email list.

1 See Struggling Corporate Borrowers Turn to Private Credit to Defer Interest, Bloomberg, September 28, 2023 and A useful tool, or hidden default? Take your PIK, Private Debt Investor, September 1, 2023.