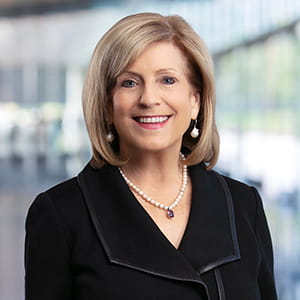

Janice Davis

Biography

Janice Davis is a partner in the Corporate Practice Group in Haynes Boone’s Dallas office.

Her practice focuses on providing counsel on a variety of commercial transactions, including mergers and acquisitions (M&A), joint ventures, divestitures, software license agreements, corporate financing, private placements, spinouts, alliance arrangements, reorganizations, recapitalizations, management and leveraged buyouts, venture capital and private equity investments, and securities law compliance.

Janice has experience in corporate and securities law, including complex international joint ventures, securities offerings, mergers, acquisitions, divestitures, outsourcing services, and private equity transactions.

Janice Davis is a partner in the Corporate Practice Group in Haynes Boone’s Dallas office.

Her practice focuses on providing counsel on a variety of commercial transactions, including mergers and acquisitions (M&A), joint ventures, divestitures, software license agreements, corporate financing, private placements, spinouts, alliance arrangements, reorganizations, recapitalizations, management and leveraged buyouts, venture capital and private equity investments, and securities law compliance.

Janice has experience in corporate and securities law, including complex international joint ventures, securities offerings, mergers, acquisitions, divestitures, outsourcing services, and private equity transactions.

- Elite Roofing Supply, Inc. and ERS Investments in connection with its sale to Gulfside Eagle Company, creating the largest family-owned and operated roofing distributor in the nation with the combined 140 branches.

- DuraServ LLC in connection with the sale of a majority stake to Leonard Green & Partners, L.P., a PE firm based in LA, California, and numerous add-on acquisitions. DuraServ is a leading provider of commercial and industrial overhead door and loading dock equipment maintenance, repair and install services. DuraServ has relationships with over 6,000 local and national customers across a diverse set of end markets, including big-box retail, food and beverage, manufacturing, transportation and logistics, among others.

- Giampaolo Group, Inc., one of North America's largest fully-integrated metal management businesses, and its wholly owned subsidiary, Matalco, a leading North American producer of recycled aluminum billet and slab, in connection with the formation of a joint venture with Rio Tinto with Rio Tinto acquiring a 50% stake in Matalco for $700 million.

- Borrego Energy, a leading EPC (Engineering, Procurement, and Construction) and O&M (Operations and Maintenance) provider in the solar and energy storage infrastructure industry, with approximately 300–340 employees and a strong presence in SCADA engineering, in connection with the spin-off of ANZA, its procurement platform for solar and energy storage equipment. ANZA, which has approximately 60–70 employees, was sold to a consortium led by Energy Capital Partners (ECP). ECP is a prominent investor in energy transition, electrification, and decarbonization infrastructure, including projects that leverage advanced SCADA and control engineering solutions.

- Cleanleaf Energy, a leader in operations and maintenance of solar and energy storage systems and other renewable energy projects, in connection with the spin-off of Borrego O&M and a Series A capital raise supporting the transaction. At the time of the spin-off, Borrego O&M had approximately 200 employees. Since becoming independent, Cleanleaf Energy has grown and currently employs around 250 people, delivering comprehensive maintenance, vigilant monitoring, and specialized O&M engineering services across its expanding portfolio.

- Smart Wires Inc. and Smart Wires Technology Ltd., a technology company that develops eco-friendly grid technology, in a series of related transactions including a private placement of ordinary shares of Smart Wires Technology Ltd. (SWT), a newly formed British Virgin Islands parent holding company, for aggregate proceeds of approximately $151 million, and the subsequent direct listing of Swedish depository receipts representing SWT ordinary shares on the Nasdaq First North Growth Market exchange in Sweden in connection with the injection of $65 million of capital in a fundraise led by BP Energy and including other investors. Smart Wires develops technologies that help utilities expand the amount of electricity carried on their grids by diverting power from congested transmission lines into less used ones.

- Arlington Orthopedic Associates, one of the largest orthopedic groups in the state of Texas, in its sale to A&M Capital Partners, as the initial platform physician practice group, as well as the sale of a portion of its ownership interest in a hospital to A&M Capital Partners.

- Matalco, a Canadian extrusion billet producer and unit of Giampaolo Group (a Toronto-headquartered global manufacturing firm), in its acquisition of Ohio Valley Aluminum Company based in Kentucky.

- PAE Incorporated, a highly diversified, global company that provides a broad range of operational solutions and outsourced services to meet critical and enduring needs of the US government, other allied governments, international organizations and companies, in its $1.9 billion sale to Amentum Government Services Holdings LLC.

- Grupo Vilaseca and Amerifoods Inc., in their acquisition of Big G, LLC, Paladin Sales, LLC, and Diana’s Bananas, LLC, which are part of their food and distribution companies, as well as a variety of other corporate transactions.

- Atlantic Broadband, a subsidiary of Cogeco Communications Inc., in its approximately $1.125 billion acquisition of WideOpenWest Inc.’s broadband systems in Ohio.

- Vincent Group plc (dba Coolbet) (Malta), a developer of proprietary gaming and sportsbook software, which it licenses to gaming operators on a business-to-business basis, in its $176 million sale to GAN Limited.

- Expeditors International of Washington, Inc. in its acquisition of Fleet Logistics’ Digital Platform.

- Walker County Hospital District and Huntsville Community Hospital in its acquisition of Huntsville Memorial Hospital, a 123-bed, nonprofit acute care community hospital.

- Braes Sneakers LP and Braes Capital in its acquisition of Siege Technologies, LLC, a provider of defensive cyber security solutions for private and government sectors.

- Brazos Presbyterian Homes Inc. and BHP Holding Co. in the acquisition of Longhorn Village, an entrance fee life plan community in Austin, Texas.

- East Texas Medical Center Healthcare System in the sale of substantially all assets to Ardent Health Services, including a network of nine hospitals, 39 clinics, two inpatient facilities, 13 regional rehabilitation facilities, physician clinics, two emergency centers, regional home health services covering 41 counties, a comprehensive seven-trauma center care network, and an EMS fleet of more than 45 ambulances and 4 helicopters.

- GTE Corporation (now Verizon Telecommunications, Inc.) in the sale of 500,000 telecommunications access lines located in nine states to Citizens Utilities Company for $1.1 billion.

- Crescent Real Estate Holdings LLC in its reorganization to dispose of a 22 property portfolio in Las Vegas, as well as negotiating and drafting the joint venture agreement and related documents with JPMorgan Chase in connection with the development and leasing of the $225 million, 20-story Uptown tower known as McKinney Olive, which won the Dallas Business Journal Award for the Best Real Estate Deals 2015: Mixed-use Development Urban.

- Parkland Center for Clinical Innovation (PCCI) in a complex spin-off transaction involving the licensing of software to Pieces Technologies Inc., an innovative healthcare analytics entity that deploys cutting-edge technology to improve clinical and community health outcomes; Pieces Tech officially launched with a $21.6 million Series A funding round led by Pacific Advantage Capital and Jump Capital, with participation from various healthcare systems and select Dallas family offices, among others.

- Served as “in-house” counsel on a seconded basis to Roofing Supply Group LLC (RSG) and provided legal advice and strategies needed for corporate risk management, compliance matters, and merger and acquisition transactions, and was directly responsible for all corporate governance, record keeping and corporate obligations for complex corporate structure; RSG in connection with four separate add-on acquisitions, a $225 million 144A Private Bond Offering, and the sale of RSG from the Sterling Group to funds managed by Clayton, Dublier & Rice.

- Poco Graphite Holdings, LLC in its $158 million merger with a subsidiary of Entegris Inc., a publicly traded materials management company.

- Fidelity National Information Services Inc. in four separate transactions involving the purchase of privately held companies in the mortgage ancillary services business with purchase prices ranging from $40 million to $100 million.

- Lingualcare Inc. in its merger with a subsidiary of 3M Company.

- Virbac Corporation in the sale of its consumer products division to Sergeant's Pet Care Products Inc., in the acquisition of assets of a privately held company owning water chemical testing technology, and in the acquisition of a separate privately held company owning oral liquid electrolyte products.

- Tech Pharmacy Services Inc. in its recapitalization by private equity firms led by DFW Capital Partners, a New Jersey-based venture capital fund, and in prior private equity investment by NeighborCare Inc. (now Omnicare Inc.).

- MD Anderson in its broad exclusive licensing agreements and equity documents with respect to, among others, the following issuers: (a) Intrexon Corporation and ZIOPHARM Oncology; (b) Immatics US Inc., with respect to structuring the initial round of a $60 million Series A financing round; and (c) OncoResponse, an immuno-oncology antibody discovery company, that was launched jointly by MD Anderson and Theraclone Sciences, which led the Series A Preferred Stock round, and which included ARCH Venture Partners, Canaan Partners, William Marsh Rice University, and Alexandria Real Estate Equities.

- DE Shaw affiliate in its proposed investment in home equity mortgage business structured as a preferred trust transaction.

- Xpressdocs Partners Ltd. in its recapitalization by private equity firms led by Polaris Venture Partners, a Massachusetts-based venture capital fund.

- Domino Printing Sciences plc in its acquisition of a privately held company owning a system that applies identifying UPC codes to end products.

- Equilon Enterprises LLC in a joint venture agreement and related documents with Globeground North America LLC with respect to airport services.

- A private equity real estate fund in its formation, capital raising efforts, and securities offering.

- Exeter Finance Corp. (a portfolio company of Blackstone LP) in a $60 million investment by private equity firms led by Navigation Capital Partners, an Atlanta-based venture fund, and separately in a high-yield debt offering to private investors.

- Resercom LP in its corporate organization and startup equity financing.

- Member, Dallas Leadership Committee, 50/50 Women on Boards

- Member, American Bar Association

- M&A Subcommittee representative for the 2009 and 2017 Private Target Mergers & Acquisitions Deal Points Studies, and the 2016 Private Target Carve-Out Deal Points Study

- Member, Dallas Bar Association

- President (2010)

- Board Member, Corporate Counsel Section (2005–2026)

- Corporate Securities Section; Real Estate Section; Technology Section

- Fellow, Texas Bar Foundation (2013–2026)

- Adjunct Professor, Business Law, Southern Methodist University (2012–2017)

- Associate of Corporate Growth (2016-2026)

- Member, Dallas CASA

- Board of Directors (2013–2026)

- Executive Committee (2016–2026)

- Finance Committee (2013–2026)

- Finance Committee, Incoming Chair (2018)

- Chair (2026-2028)

- Member, Broadway Dallas, fka Dallas Summer Musicals

- Board of Directors (2005–2026)

- Executive Committee (2016–2017)

- Finance Committee (2010–2024)

- Governance Committee (2023-2026)

- Leadership Dallas (2003–2004)

- Board of Trustees, Texas General Counsel Forum (2004–2017); Chair, 2008 Annual Conference; Chair, 2009 Annual Dedman Dinner

- Recognized in The Best Lawyers in America, Woodward/White, Inc., for Corporate Law, 2010-2026, and Mergers and Acquisitions Law, 2010-2026

- D CEO and the Association for Corporate Growth (ACG) Dallas/Fort Worth named Janice the 2025 Attorney of the Year at the 12th Annual Mergers & Acquisitions Awards, 2025

- Recommended, Technology: M&A/corporate and commercial: M&A: large deals ($1bn+), The Legal 500 US, 2020

- Recommended, Media, Technology and Telecoms: Technology transactions, The Legal 500 US, 2020

- Recognized, IAM Patent 1000: The World's Leading Patent Professionals, 2018-2019

- Ranked, Technology: Corporate & Commercial, Texas, Chambers USA, 2018

- Recommended, Technology: Transactions, The Legal 500 US, 2015, 2018

- Dallas’ Top 50 Women in Law, Texas Diversity Council, 2018

- Recipient, Texas Women Ventures Fund Breakthrough Award, 2011

- Martindale-Hubbell® AV® Preeminent Rating

Education

J.D., Baylor University School of Law

B.S., Accounting, University of Illinois at Urbana-Champaign, high honors

Admissions

Texas

A Timeline of Janice Davis

D CEO Honors 3 Haynes Boone Lawyers Among Most Influential Business Leaders in North Texas

November 17, 2025

Haynes Boone Advises DuraServ on West Coast and Southeast Acquisitions

October 23, 2025