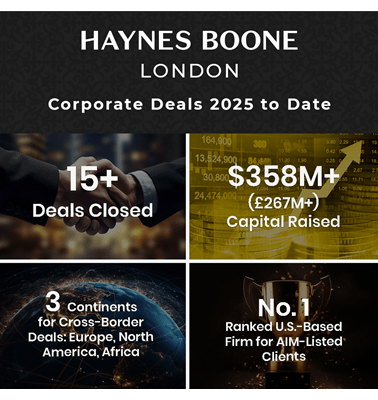

Haynes Boone’s London office has achieved a marked increase in transactional work this year, advising on 17 deals so far, spanning energy, mining, technology and life sciences and raising more than $358 million (£267 million) for clients through the first eight months of 2025. The transactions highlight the office’s expanding role in cross-border capital markets and corporate matters across the United Kingdom, North America and Africa.

The outstanding volume of deal activity follows the arrival of London Co-Office Managing Partner Nick Davis and his seven-lawyer capital markets team earlier this year, adding to the office’s established capabilities under existing partners such as Karma Samdup and Tom Ferns. Together, the expanded group has strengthened the office’s equity capital markets and AIM-listing capabilities, resulting in the firm’s strong debut in ARL’s Corporate Advisor Rankings Guide, where Haynes Boone is first overall among U.S.-based firms in total AIM-listed clients, as well as No. 1 among U.S. firms serving technology and basic materials clients.

Diverse Deal Activity Across Sectors

Haynes Boone London’s 2025 transactions span multiple industries and deal types:

- Energy: Six transactions, including fundraisings for hydrogen, helium and oil-and-gas exploration companies as well as transitional energy mandates. Highlights include advising AFC Energy PLC on a $37.3 million (£27.5 million) AIM fundraising, Zephyr Energy PLC on a $14.2 million (£10.5 million) fundraising, connecting U.S. oil-and-gas assets with London capital markets through an oversubscribed placing, and Helix Corporation on a $6.1 million (£4.5 million) fundraising to accelerate its helium development plans in northern Montana.

- Mining: Three transactions involving phosphate, potash and metals exploration companies. The matters include advising Guardian Metal Resources PLC on a $21.2 million (£15.6 million) fundraising, Kore Potash on a $11 million (£8.1 million) fundraising and Power Metal Resources PLC on a $12.5 million (£9.2 million) strategic disposal of its stake in Guardian Metal Resources.

- Technology and Infrastructure: Eight transactions, highlighted by Raxio Group’s $100 million (£73.8 million) financing with the International Finance Corporation and Proparco to expand its data center network across Africa. Other notable matters include NordicNinja’s Series B Investments in AI-powered delivery platform HIVED ($44.7 million/£33 million) and Fintech platform Lightyear Financial Ltd. ($24.4 million/£18 million) as well as Beacon Capital’s $31.2 million (£23 million) Series B investment in legal tech company Definely.

- Life Sciences and M&A: Notable matters include GROW Group PLC’s acquisition of UK-based Avida Medical Ltd. and Omnia Payroll Limited’s acquisition of Magi Group Limited, expanding their respective capabilities in medical cannabis and contractor services.

Key Trends Emerging from 2025 Deals to Date

- Capital Markets Momentum: Nearly every transaction involved capital markets work, often in oversubscribed raises, signaling strong investor demand and execution strength.

- Sector Diversity: Activity spanned transitional energy, mining and frontier natural resources, AI-driven logistics, gaming, life sciences and infrastructure, reflecting increased client demand across a wide range of industries.

- Cross-Border Complexity: Deals connected clients and investors across the UK, North America and Africa, aligning with the firm’s global platform.

- Growth Through Strategic Hires: The arrival of Davis and the corporate team accelerated deal volume and broadened the scope of client mandates, adding tech-focused venture and cross-border transactions to the office’s existing energy and AIM work.

Sustained Growth and Outlook

London has grown to become Haynes Boone’s largest international office and fourth largest overall, now with approximately 60 lawyers. Building on this growth and on the back of increased activity during the first half of 2025, the London corporate and investments team anticipates continued deal flow into 2026 as clients pursue capital markets and cross-border opportunities.