The firm advised energy and AI infrastructure pioneer Fermi on its novel $682.5 million IPO supporting a multi-gigawatt data campus — the first simultaneous dual listing on the Nasdaq and LSE this century and one of the largest IPOs in London Stock Exchange history.

Haynes Boone represented Fermi America—an energy company co-founded by former U.S. Energy Secretary Rick Perry and CEO Toby Neugebauer—in its initial public offering (IPO), which values the company at $13.8 billion. The company is structured as a real estate investment trust (REIT), reflecting the income-generating nature of its large-scale data infrastructure. The historic transaction marks the first time this century that a company has launched an IPO with a simultaneous dual listing on both the Nasdaq (Oct. 1) and the London Stock Exchange (Oct. 2), where it will trade under the ticker symbol FRMI.

The offering raised $682.5 million through the sale of 32.5 million shares at $21 per share. This, together with Fermi’s $13.8 billion market cap, ranks the transaction amongst the largest IPOs in LSE history.

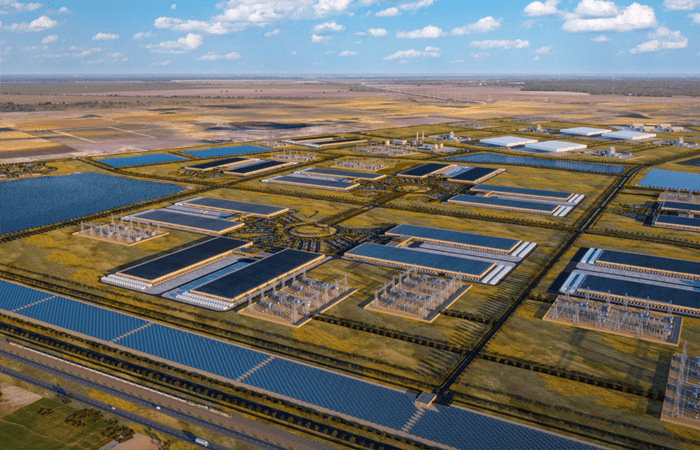

The IPO supports Fermi’s Project Matador, one of the largest privately led energy infrastructure projects in U.S. history and among the world’s biggest data center complexes. The 5,000-plus-acre campus in Amarillo, Texas, is designed to deliver 11 gigawatts of power and 18 million square feet of artificial intelligence facilities powered by nuclear, natural gas, solar and battery storage. IPO proceeds will fund construction, equipment, hiring, power and pipeline infrastructure.

“In working around the clock and sharing the sense of urgency required for us to execute on the world’s largest private-grid campus to power the future of AI, the team at Haynes Boone have been more than our lawyers—they have been true partners,” said Neugebauer.

The deal drew on Haynes Boone’s global experience in capital markets, energy, technology and infrastructure transactions as well as finance, tax and REIT structuring to advise on the offering’s U.S. and U.K. aspects. The capital markets team was led by Dallas Partner and Co-Chair Matt Fry, London Partners Nick Davis and Robert Bines-Black and Dallas Associate Logan Weissler.

“It is an honor to advise on the first-ever dual listing of this kind, which required close coordination across jurisdictions and disciplines,” Fry said. “Fermi’s IPO is a landmark moment not just for the markets, but also for how innovation and infrastructure deals are executed globally.”

“The Dallas and London offices of Haynes Boone have together seamlessly enabled one of the world’s most dynamic and fastest growing companies to access both the Nasdaq and London Stock Exchange markets,” said Davis, co-office managing partner in London. “This novel dual listing, which is a testimony to the changes in the rules in the London market to successfully attract high-growth companies, has not been done in last 30 years, and we hope it is the first of many. We wish Fermi the greatest of success and look forward to working with them to deliver this vital project over the next few years.”

The Fermi IPO underscores the continued growth and steady deal activity from Haynes Boone’s London office, which has advised on 19 transactions this year spanning energy, mining, technology and life sciences. A key component of the firm’s global capital markets work, the London team plays an integral role in cross-border offerings and dual listings spanning the U.S., U.K. and emerging markets. As a result, Haynes Boone ranks first among all U.S.-based firms in total AIM-listed clients, per ARL’s Q3 Corporate Advisor Rankings Guide.

The IPO deal team supporting Fry, Davis, Bines-Black and Weissler also included contributions from:

- Capital Markets Associates David McClellan, Ravina Mahajan, Mike Haden, Alexandria Pencsak, Walt Cory and Tyler Murry, and Trainee Solicitors Ziv Gould and Tautvydas Medzuekevicius

- Finance Partners Sakina Rasheed Foster, Gilbert Porter and Matt Frankle, Counsel Cody Cravens and Associate Joy Su

- Mergers and Acquisitions Partner Larry Shosid

- Employee Benefits Partners Susan Wetzel and Scott Thompson, and Counsel Tom Hogan

- Tax Partners Michael DePompei (REIT structuring) and Sam Lichtman

- Energy Partners Diana Liebmann, Phil Lookadoo and Mary Mendoza, and Associate Victor K. Salazar

- Labor and Employment Partner Raquel Alvarenga

Haynes Boone’s Capital Markets Practice advises on high-value public offerings, including IPOs, PIPEs, reverse mergers and dual listings. The team has led landmark deals across energy, tech, life sciences and financial services, including one of the largest IPOs in LSE history and the first Nasdaq-LSE dual listing of this century. Clients rely on our cross-border experience and integrated counsel across major U.S., U.K. and global exchanges for securities transactions, compliance and REIT structuring.